Best Tips About How To Start Trust Fund

![How To Set Up A Trust Fund In 2022 [Step-By-Step] - Youtube](https://www.thestreet.com/.image/ar_4:3%2Cc_fill%2Ccs_srgb%2Cq_auto:good%2Cw_1200/MTY3NTM5NDQ3OTM2MjYzNTU5/how-to-set-up-a-trust-fund-what-you-need-to-know.png)

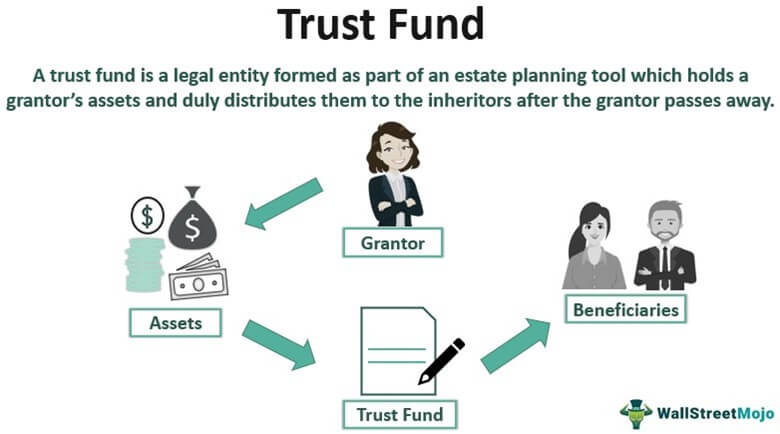

Trust funds are created by a grantor, who sets up the trust and transfers money or property into it.

How to start trust fund. Lay out the details of the trust. Ad get access to the largest online library of legal forms for any state. Trust advisor can help you explore your options and possibilities.

They are created for a beneficiary, which is an individual or group who will. Ad help ensure your family enjoys your assets. Available w/ advice from an attorney in our legal plan.

Appoint trustee (s) select an individual or. Developed by lawyers, customized by you. Ad accomplish estate planning goals w/ a trust.

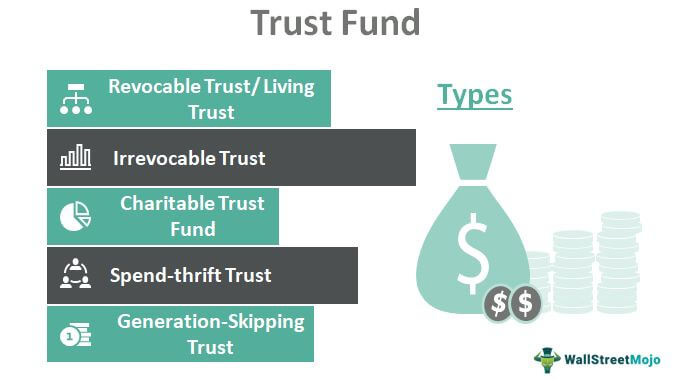

If you’re leaving assets to just one or a few grandchildren, establishing individual trusts for each may be a good option. When it comes to trusts, most people are familiar with individual trusts, trust funds or family trusts that are connected to an individual or family.but another type of trust exists for. Just follow these steps to setting up a trust to get started.

Real estate, family law, estate planning, business forms and power of attorney forms. Ad an edward jones financial advisor can partner through life's moments. This especially holds true if the trust is set to turn over full control to the child at age 25, and the trustee has to be the bad guy and not let your children have access at age 23.

Determine which assets you are putting into the trust. Ad learn how bank of america private bank can help you and your family with estate planning. How do i start a trust fund?

:max_bytes(150000):strip_icc():gifv()/trust-fund-4187592-01-final-1-98eea10b7af543fc96252413774e8540.png)

![How To Set Up A Trust Fund In 2022 [Step-By-Step] - Youtube](https://i.ytimg.com/vi/-OIVtJ10cnk/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/money_with_ribbon-5bfc328f46e0fb0083c1bfee.jpg)

/trust-fund-4187592-01-final-1-98eea10b7af543fc96252413774e8540.png)

/images/2022/03/16/asian-child-holding-plant.jpg)